Odoo is the world's easiest all-in-one management software.

It includes hundreds of business apps:

- Müşteri İlişkileri Yönetimi

- e-Commerce

- Muhasebe

- Envanter

- PoS

- Proje Yönetimi

- MRP

Bu soru işaretlendi

Instead

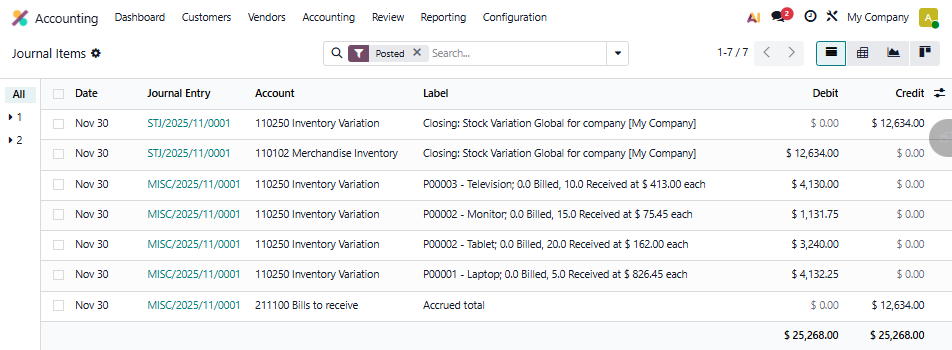

- Costs are stored directly on incoming and remaining stock moves (not outgoing)

- Posting is delayed until invoicing

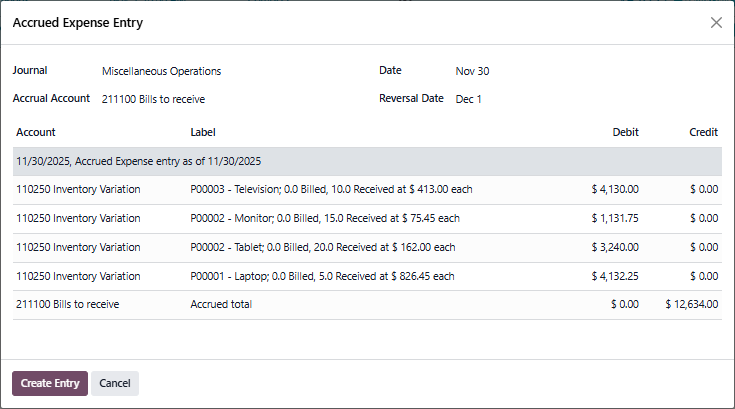

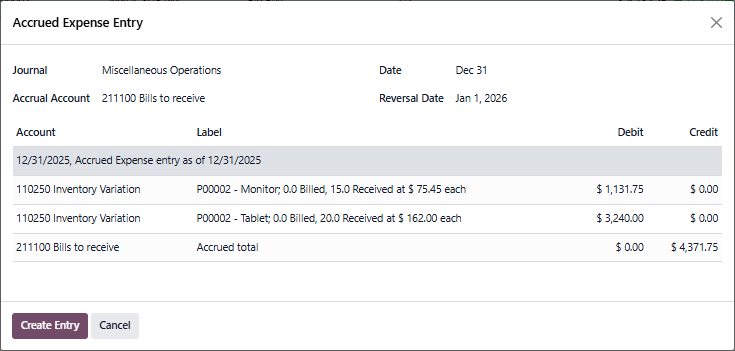

- Accrual entries are used for good receipts/deliveries not invoiced (GRNI and GDNI)

- Accrual entries are used for invoiced not received/delivered goods (GINR and GIND)

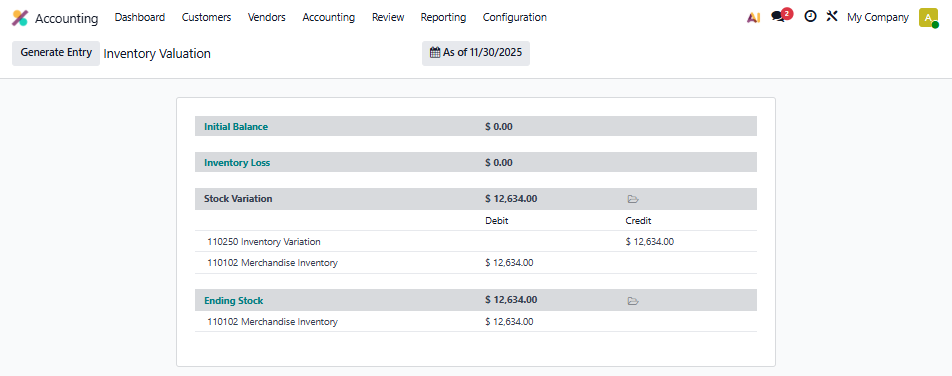

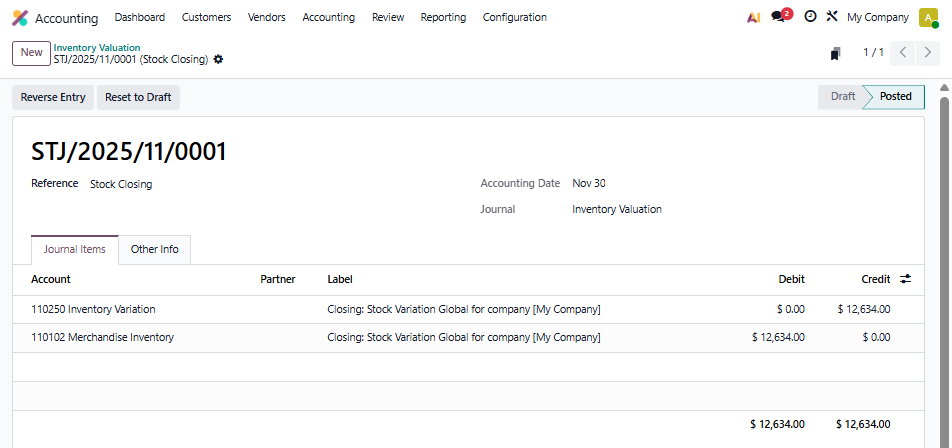

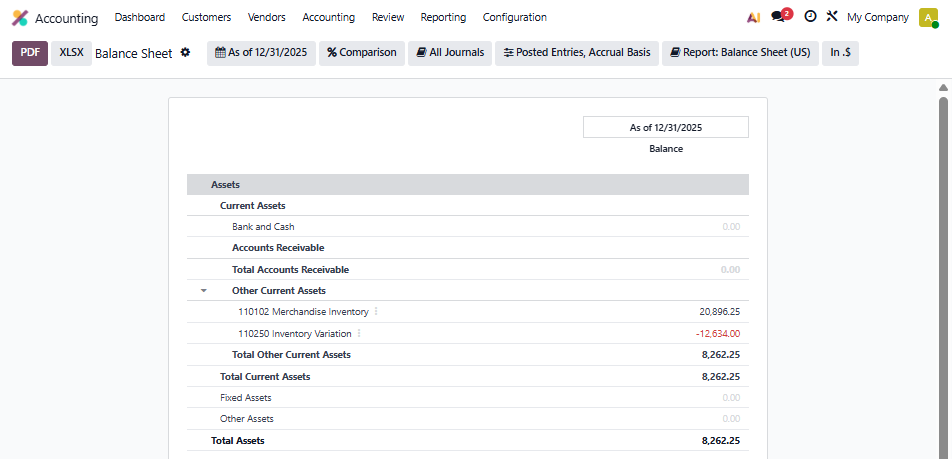

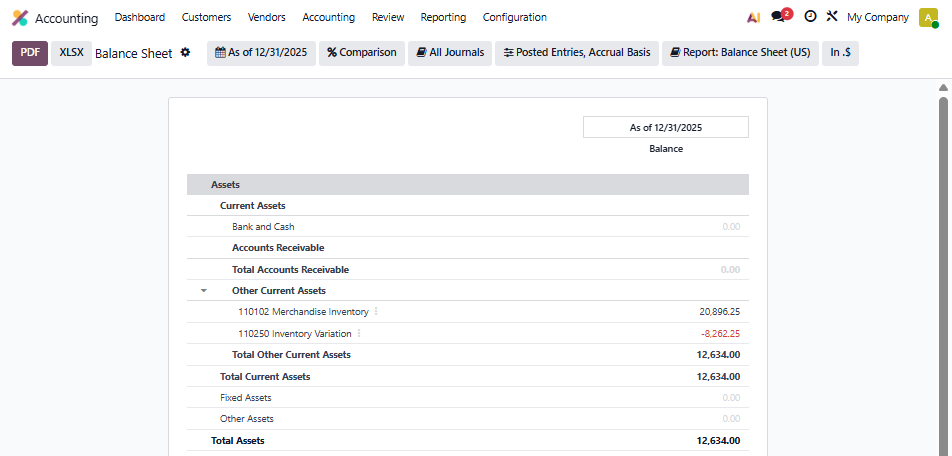

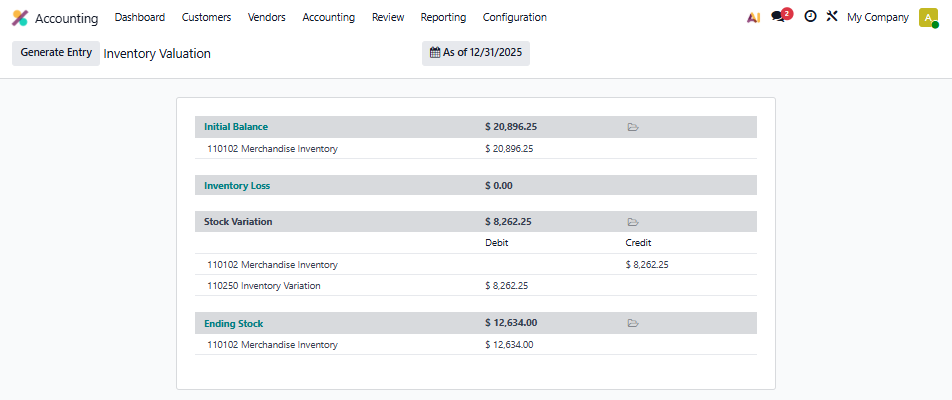

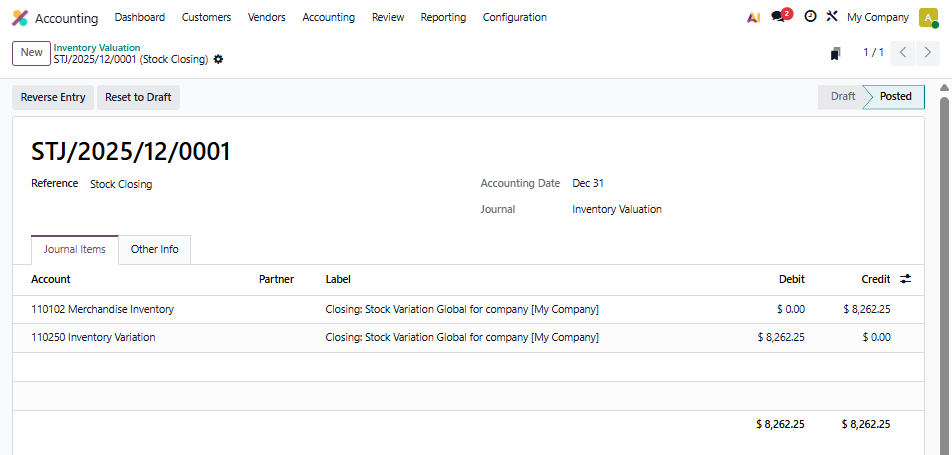

- A closing entry reconciles the Inventory Stock Report with the Balance Sheet

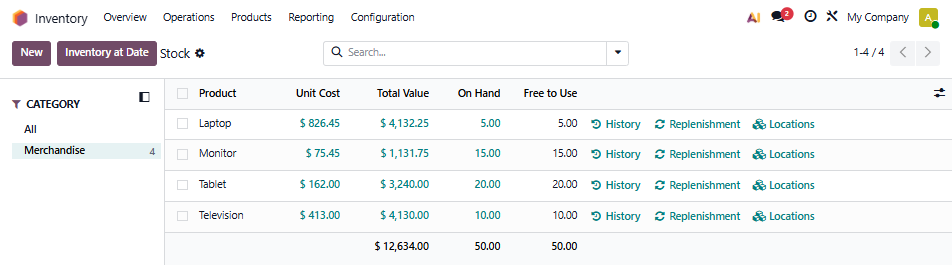

- The Inventory Stock Report is now your real‑time source

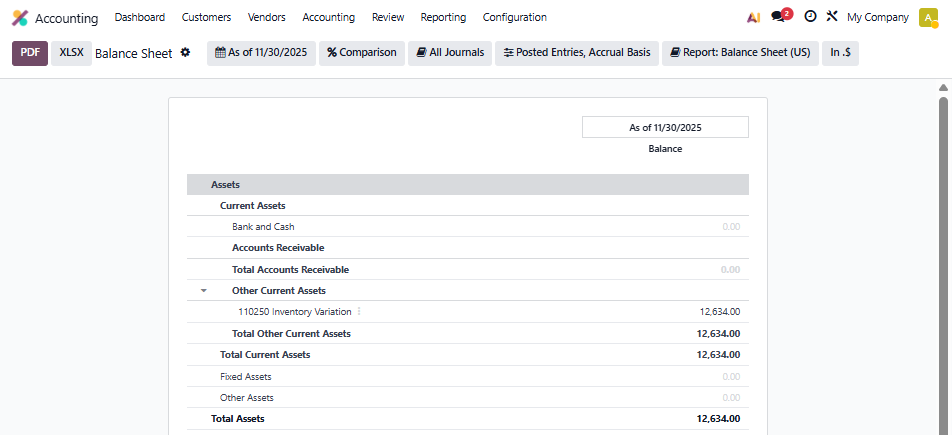

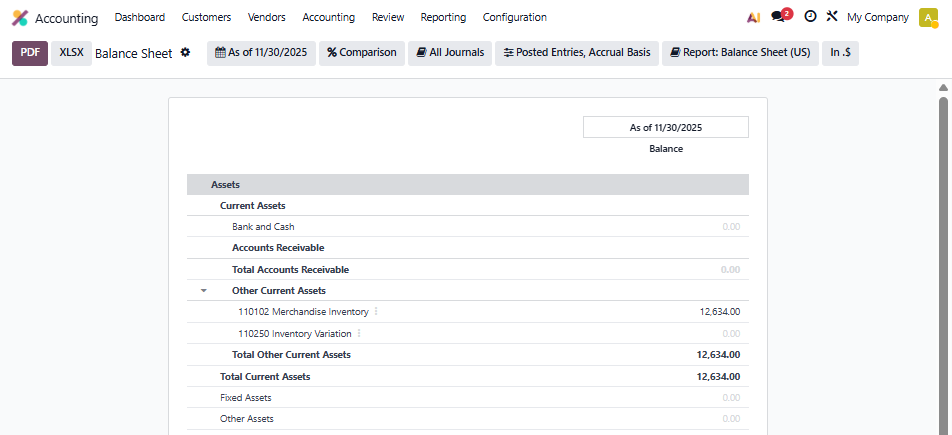

- The Balance Sheet is accurate only after closing

Configuration used in this answer

- Perpetual (at invoicing) Inventory Valuation Method

- the Average Price Costing Method

- a current asset Stock Variation account configured as the Variation Account on the Stock Account of the Product Category

Where to Find the Details

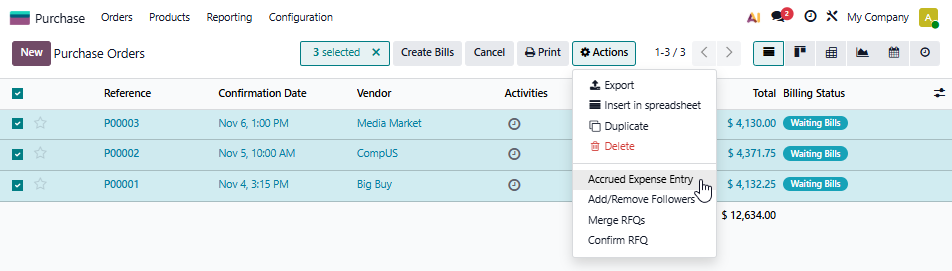

- Product‑level detail comes from Accrual Entries

- Accrued Expenses (purchases received but not billed and billed not received)

- Accrued Revenue (sales delivered but not invoiced and invoiced not delivered)

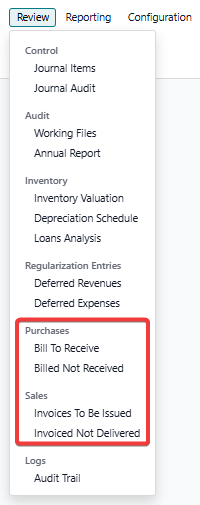

- In addition to being available in the Sales and Purchases Apps (after selecting relevant Orders and using the Action Menu), these are now accessible from the Accounting app under Regularization Entries (e.g., “Bills to Receive,” “Invoices to be Issued”)

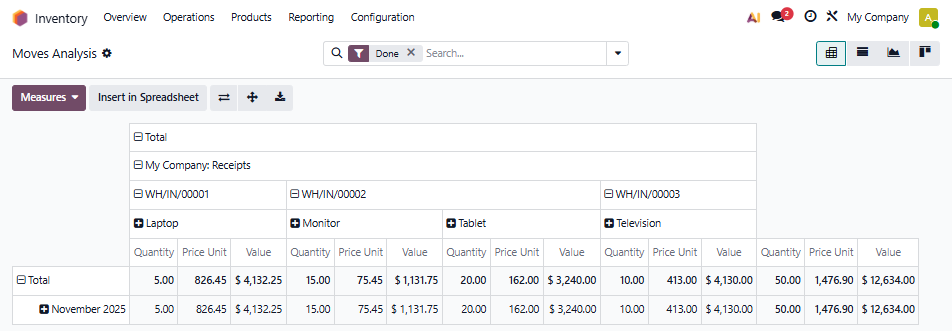

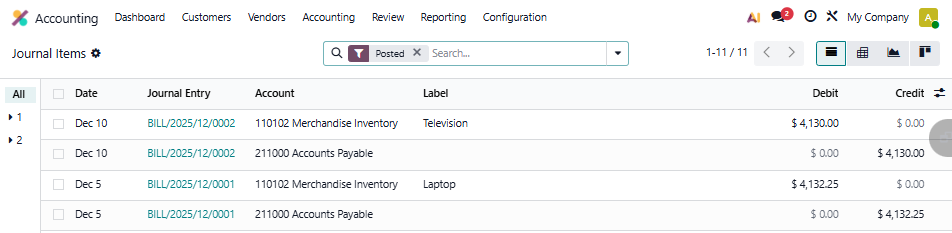

Step by Step Example

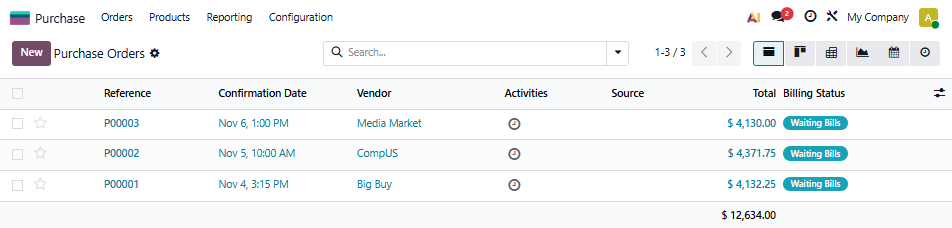

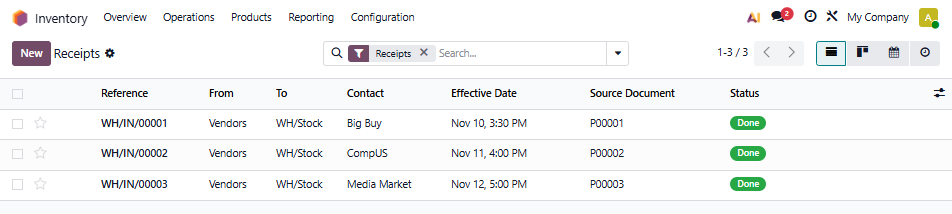

- order four products from three vendors

- do not receive any Vendor Bills

- follow the period end close process

- see how Odoo accounts for the inventory postings we can expect when Bills arrive

- see how Odoo updates the Balance Sheet

- receive our Vendor Bills

- follow the period end close process

What This Means for You

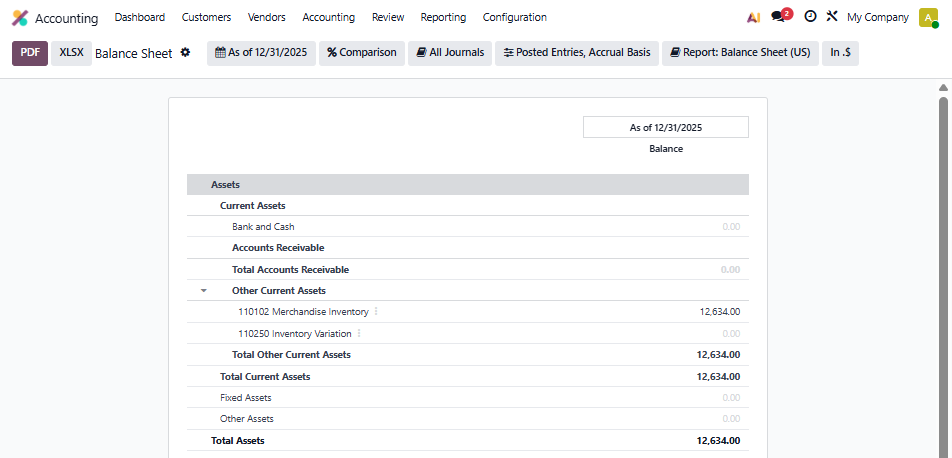

- Balance Sheet: Only accurate after closing entries are run (daily, monthly, or on demand)

- Inventory Stock Report: Your real‑time view of quantities and values - always

- Accrual Entries: Provide the missing detail for product receipts/deliveries not yet invoiced or invoices for products not received/delivered

- Reconciliation: Closing entries + accrual entries ensure the Balance Sheet matches operational reality

Key Takeaways

- Don’t expect the Balance Sheet to reflect live inventory between running the closing entry

- Use the Inventory Stock Report for operational decisions

- Run accrual entries and closing entries regularly to keep financials aligned

- Think of this as a subledger approach: operational stock vs. financial accounting snapshots

Additional background on postings

Direct posting - Operation is Trigger

- physical inventory; scrap; manufacturing orders

Delayed posting - Financial Step is Trigger

- inventory revaluation; delivery, receipt, return of goods; landed costs

Hi @Ray,

One thing I notice here is that:

+ If we use "Create Accrued Expense Entry" in Purchase app, Odoo will generate the entry in which COGS is debited and Accruals is credited. What we expect here is Variation account is debited not COGS.

+ If we generate the accrual entry from "Bill to receive" in Accounting app, Odoo doesn't allow us to choose Current Liability account as the accrual account.

How can we deal with this situation?

I suggest you work with Support - odoo.com/help - as you probably have a configuration issue. The Accrued Expenses generates the type of entry I have posted above.

Enjoying the discussion? Don't just read, join in!

Create an account today to enjoy exclusive features and engage with our awesome community!

Üye Ol| İlgili Gönderiler | Cevaplar | Görünümler | Aktivite | |

|---|---|---|---|---|

|

|

1

Kas 25

|

518 | ||

|

|

1

Kas 25

|

647 | ||

|

|

3

Kas 25

|

394 | ||

|

|

0

Kas 25

|

28 | ||

|

|

2

Nis 25

|

2608 |