Prerequisite:

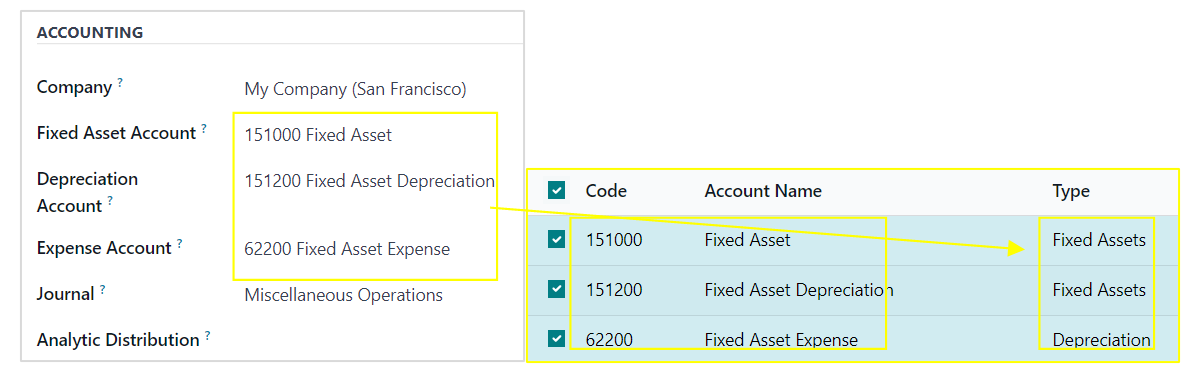

1. The following example is in version 17 with USA localization. The configuration should apply to most of the versions with slight differences.

Use case:

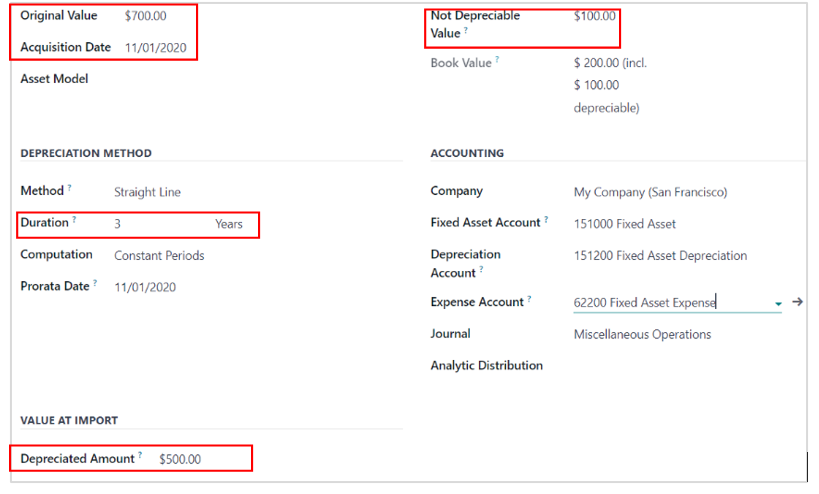

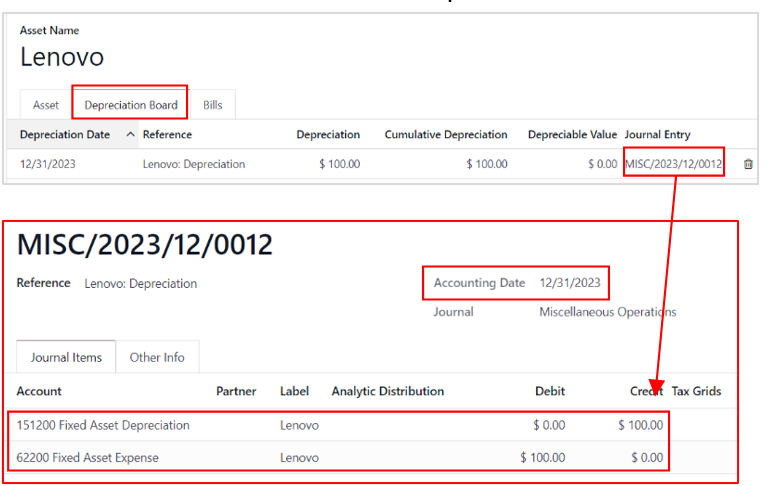

1. We purchased a fixed asset called: Lenovo computer for $700 on 2020/11/1.

2. The non-depreciated value is $100.

3. We start using Odoo on 2023/1/15.

4. By 2023/1/15, we had depreciated in the old system for $500 on the fixed asset.

5. The fixed asset book value as of 2023/1/15 is $200.