I have for instance cash deposits that are already reconciled with invoices. How can I reconcile the general account concerned - which is not linked to a partner - from my bank statement?

Odoo is the world's easiest all-in-one management software.

It includes hundreds of business apps:

- CRM

- e-Commerce

- Księgowość

- Zapasy

- PoS

- Project

- MRP

To pytanie dostało ostrzeżenie

In the new Bank Statement Reconciliation (V8) you have the ability to reconcile other accounts than receivable and payable ones. For those accounts you need to reconcile (without adding a partner in the bank statement), you just have to tick Allow Reconciliation for the account concerned (menu Accounting > Configuration > Accounts > Accounts).

When you encode (or import) the bank statement, leave the partner empty in the bank statement line concerned. When you click the Reconcile button, all the unreconciled entries for all accounts which allow reconciliation will be displayed (and not only payable/receivable). Then you can filter on the account code to make your searches faster. Select the counterpart to be reconciled by clicking the + in front of the line, then click OK. The entries will now be reconciled. This should solve the clearing accounts of card payments, deposits, etc.

When you return to the bank statement, you can click the Journal Items button to display all reconciliations made from this statement.

In the latest RC leaving the partner blank actually results in an exception that states "Reconcilation can only be done for transactions against the same partner.". Not sure about the work-around other than just providing the partner for each transaction on the bank statement.

Seems to be okay now.

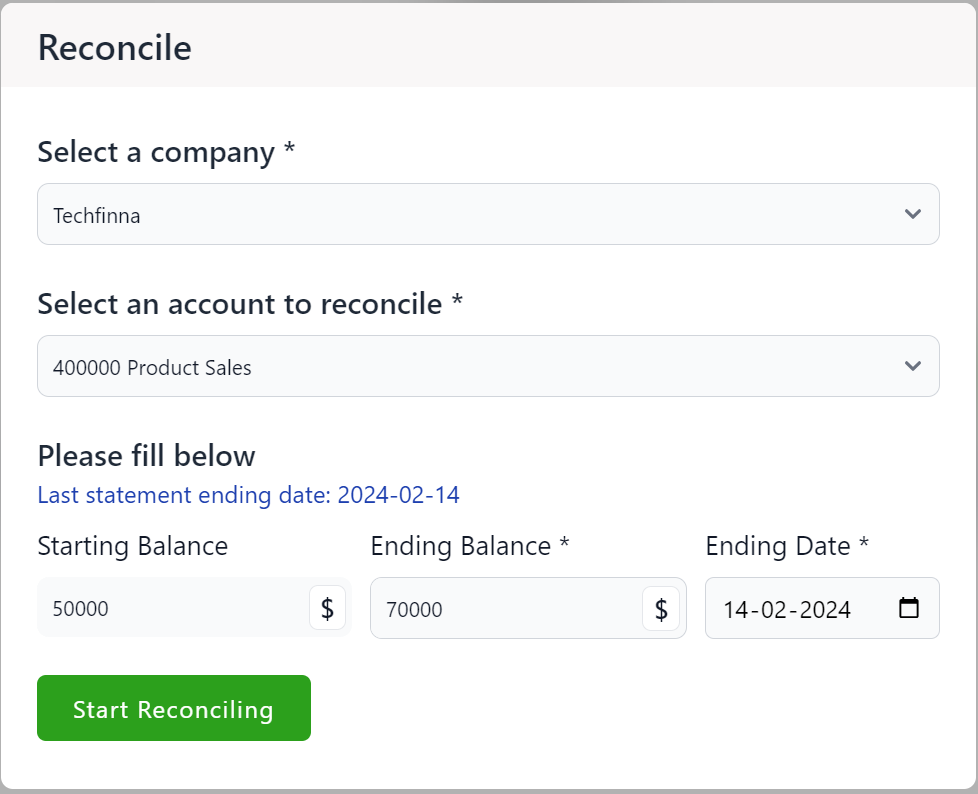

You can use this app which is easy to use and has been appreciated by accountants https://apps.odoo.com/apps/modules/17.0/quickbooks_manual_reconcile/

The answer given by Els Van Vossel is 100% correct

however I would like to add. A bank reconciliation consists of two columns; one for the book balance, the other for the bank balance. The person reconciling the accounts then adjusts one column by adding deposits that had not yet been recorded and subtracting checks and other outlays that had not yet been cashed when the statement had been prepared. The reconciliation is not complete until the adjusted column equals the unadjusted column. There may be some cases where the process reveals a legitimate transaction that was not recorded in the books. When that occurs, the person responsible for the business's books must record the transaction using a journal entry.

It must be forbiden to reconcile entry with different partners.

The partner is a auxiliary account.

As far as I know you do not reconcile journal entries with different accounts ?

The batch reconciliation is a functionality lack I agree but it has to be done a different way

I fully agree with the fact that you do not reconcile different partners. My "seems okay now" was meant for the reconciliation of a general account without a partner.

Ok. Good to read it. Today these constraint have been removed totally from v8. Meaning you can do any kind of reconciliation :( This is a very dangerous regression.

Podoba Ci się ta dyskusja? Dołącz do niej!

Stwórz konto dzisiaj, aby cieszyć się ekskluzywnymi funkcjami i wchodzić w interakcje z naszą wspaniałą społecznością!

Zarejestruj się| Powiązane posty | Odpowiedzi | Widoki | Czynność | |

|---|---|---|---|---|

|

|

1

wrz 25

|

577 | ||

|

|

1

sty 23

|

3115 | ||

|

|

0

maj 24

|

2449 | ||

|

|

0

lip 23

|

2448 | ||

|

|

1

kwi 22

|

3410 |