Electronic invoicing (EDI)¶

EDI, or electronic data interchange, is the inter-company communication of business documents, such as purchase orders and invoices, in a standard format. Sending documents according to an EDI standard ensures that the machine receiving the message can interpret the information correctly. Various EDI file formats exist and are available depending on your company’s country.

EDI feature enables automating the administration between companies and might also be required by some governments for fiscal control or to facilitate the administration.

Electronic invoicing of your documents such as customer invoices, credit notes or vendor bills is one of the application of EDI.

Odoo supports, among others, the following formats.

Format Name |

Applicability |

|---|---|

Factur-X (CII) |

All customers |

Peppol BIS Billing 3.0 |

All customers |

XRechnung (UBL) |

All customers |

Fattura PA (IT) |

Italian companies |

CFDI (4.0) |

Mexican companies |

Peru UBL 2.1 |

Peruvian companies |

SII IVA Llevanza de libros registro (ES) |

Spanish companies |

UBL 2.1 (Columbia) |

Colombian companies |

Egyptian Tax Authority |

Egyptian companies |

E-Invoice (IN) |

Indian companies |

NLCIUS (Netherlands) |

Dutch companies |

EHF 3.0 |

Norwegian companies |

SG BIS Billing 3.0 |

Singaporean companies |

A-NZ BIS Billing 3.0 |

All customers |

Note

The Factur-X (CII) format enables validation checks on the invoice and generates PDF/A-3 compliant files.

Every PDF generated by Odoo includes an integrated Factur-X XML file.

See also

Configuration¶

By default, the format available in the send window depends on your customer’s country.

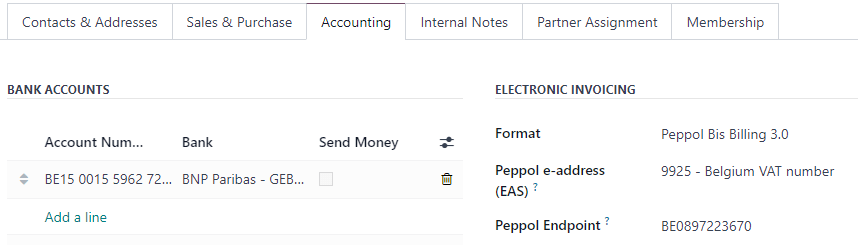

You can define a specific e-invoicing format for each customer. To do so, go to , open the customer form, go to the Accounting tab and select the appropriate format.

Peppol formats¶

Use the fields Peppol e-address (EAS) and Peppol Endpoint to identify the recipient in the Peppol Network.

Example

Partner’s country |

Peppol e-address (EAS) |

Peppol Endpoint |

|---|---|---|

Luxembourg |

9938 - Luxemburg VAT number |

a valid Luxemburgish VAT number |

Netherlands |

0190 - Dutch Originator’s Identification Number |

a valid OIN number |

Belgium |

9925 - Belgium VAT number |

a valid Belgian VAT number |

National electronic invoicing¶

Depending on your company’s country (e.g., Italy, Spain, Mexico, etc.), you may be required to issue e-invoicing documents in a specific format for all your invoices. In this case, you can define a default e-invoicing format for your sales journal.

To do so, go to , open your sales journal, go to the Advanced Settings tab, and enable the formats you need for this journal.

E-invoices generation¶

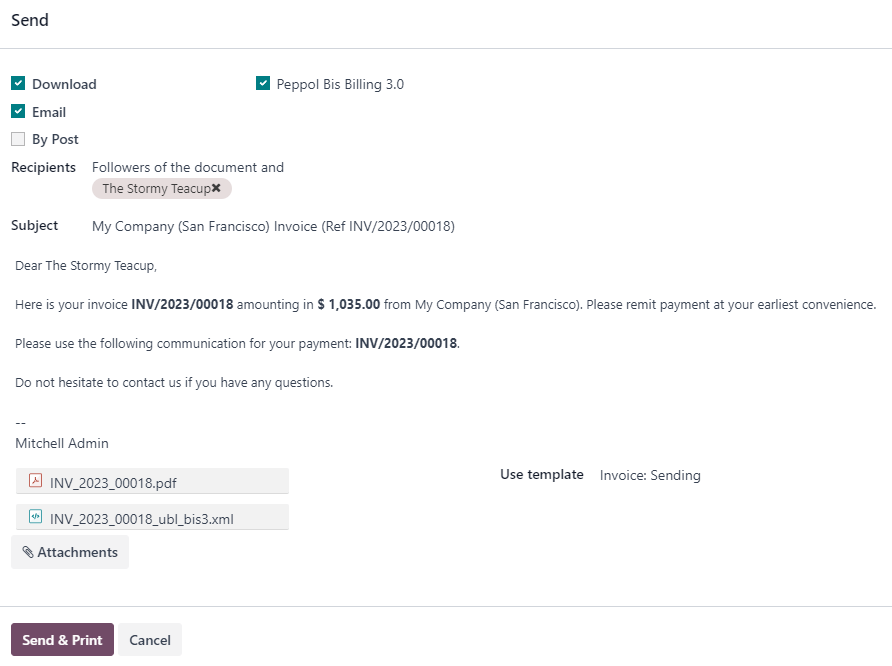

From a confirmed invoice, click Send & Print to open the send window. Check the e-invoicing option to generate and attach the e-invoice file.