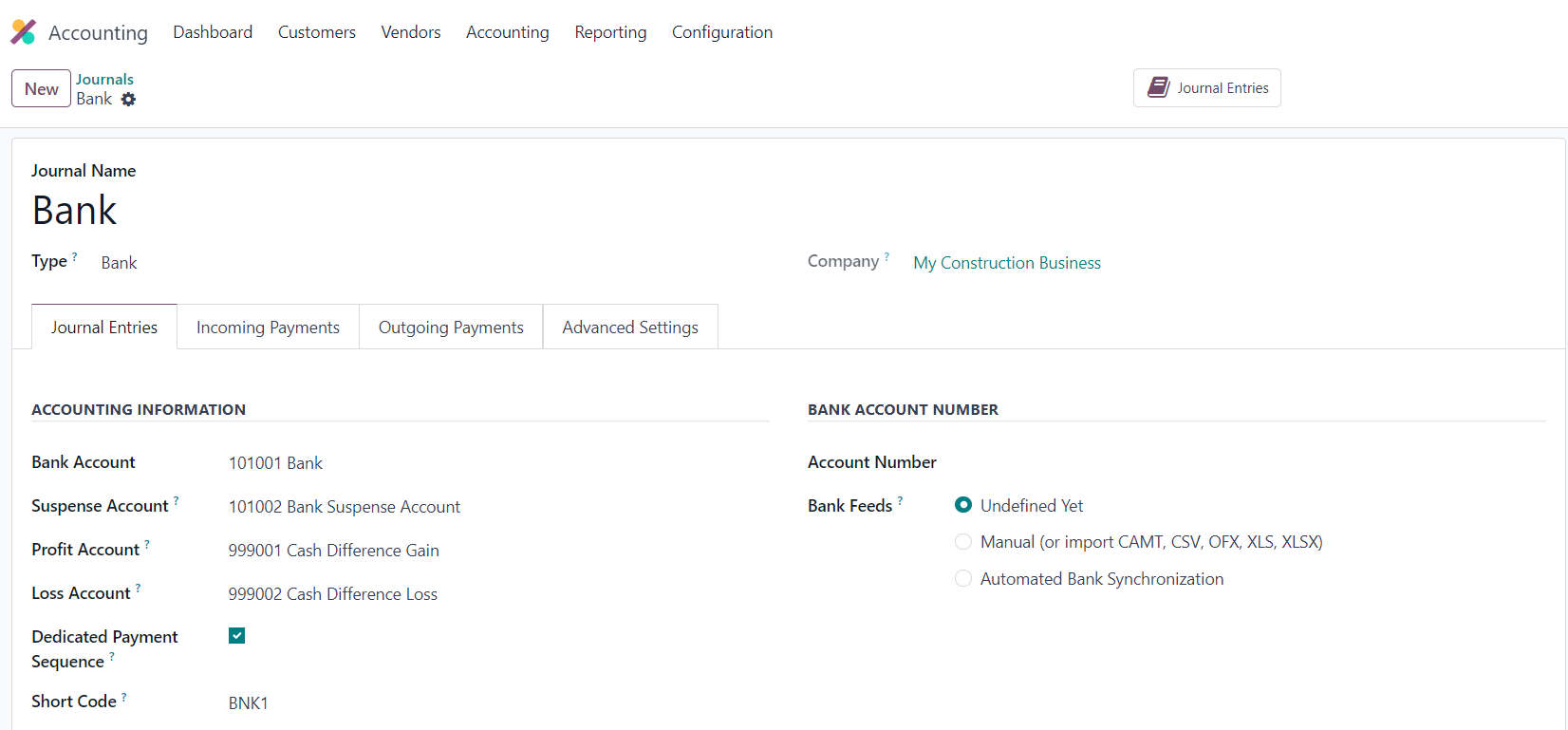

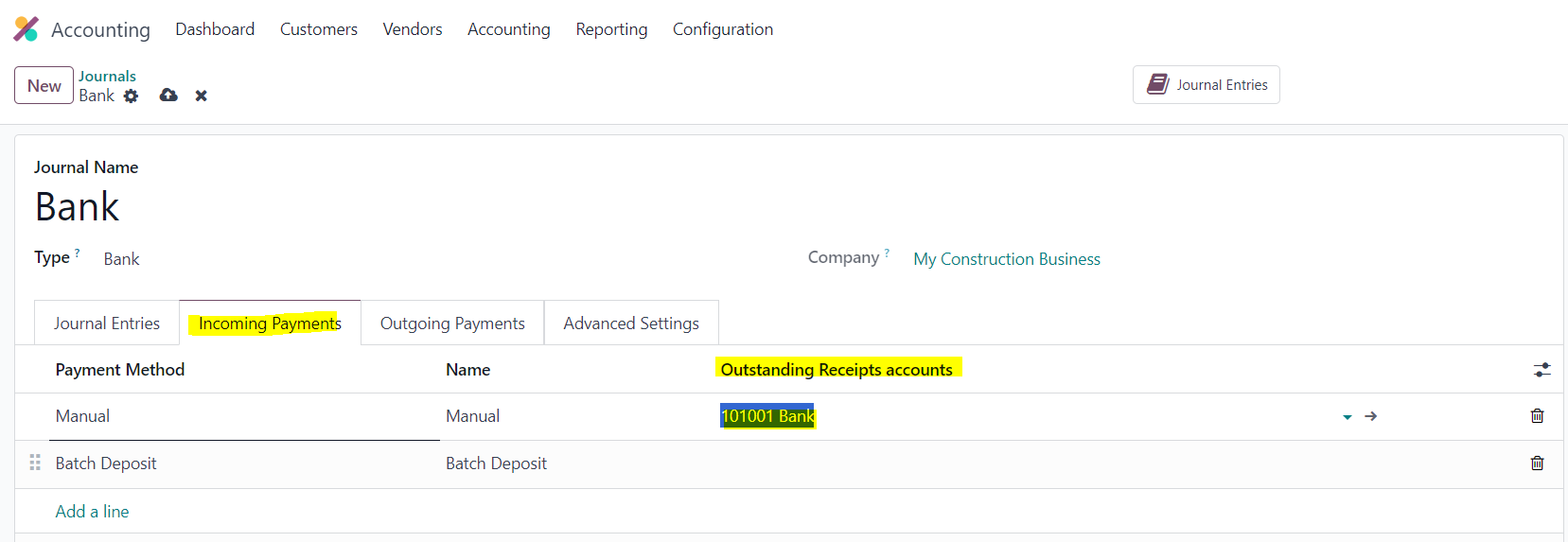

I have created a customer payment with payment type RECEIVE and journal type Bank while shaving/posting the transaction, in the journal entry, it automatically creates 2 additional entries with bank suspense account and Tax Received. But in payment type SEND those entries are not made. So, how do you disable the creation of the VAT Received line?